2nd Quarter of 2023, Des Moines Metro Lot Analysis

I love summertime in Iowa! Typically for me, summer means weekends at my parents’ lake house in Clear Lake, grilling outside with my wife and daughters, and hanging out at the Iowa State Fair and enjoying everything that it has to offer.

This summer has been even better, because I purchased my first bicycle since the one I owned in elementary school. With my new bike, it has opened opportunities to do some more fun things. In May of this year, I completed my first Ironman Triathlon. A 70.3-mile race right here in Des Moines! It required training of about 10 hours per week, strict diet, and more of a focus on sleep. I learned that it is a culture of extreme discipline, with many interesting people from interesting backgrounds that seem to share a common trait of “type-A” personalities.

On the complete opposite end of the spectrum, since I had my new bike in hand, I was able to partake in my first RAGBRAI experience. Two days of complete joy, comprising of 141 miles biked from Carroll, IA to Des Moines. Like an Ironman event, RAGBRAI is also comprised of many interesting people from interesting backgrounds that generally share a common trait of not being “type-A” personalities. Regardless, it was fun to cruise back into Des Moines on good vibes and a cool buzz with about 75,000 other riders.

Trying to figure out the state of the Des Moines metro’s lot and new construction market is like comparing an Ironman event to RAGBRAI. There really is not much correlation.

Think of it like looking at a scatter-plot chart comprised of market indicators. Historically speaking, you would expect to see a line of regression that shows a relationship between the market indicators. However, currently the scatter plot has data points all over the place. Things like publicly-traded builders’ stock prices being up while profitability is down. Interest rates are up while home prices continue to rise. Record-low unemployment while there is record-high credit card debt. The Fed has cut inflation through rate hikes, but as of June, 2023 the unemployment rate sits at 3. 6%… the exact same as March, 2022 when the rate hikes began!

On the local level, I like to look at the residential market and compare what percentage of active listings are new construction versus existing. As of 7/27/2023, there are 2,206 residential listings on the MLS for the Des Moines metro of which 1,277 are new construction. That’s about 58%. Over the last six years, this market averages around 20% of listings being new construction. This is certainly a noteworthy discrepancy.

Additionally, I like to compare the number of real estate agents on the MLS versus the number of residential listings. There are currently 3,472 agents and only 2,783 active listings on the MLS.

The following information is taken from public record, not the Des Moines MLS:

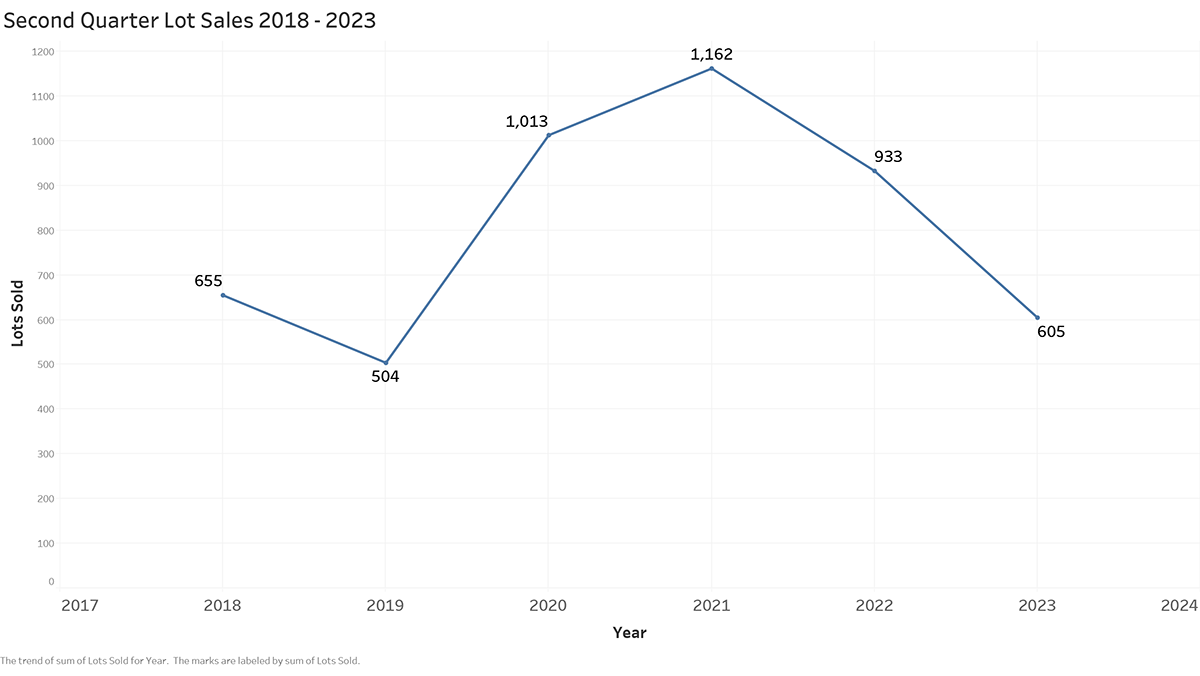

The first graph is Second Quarter lot sales from 2018–2023. On average over that period, there are 812 lot sales for the Second Quarter. 2023 is underperforming with 605 lot sales.

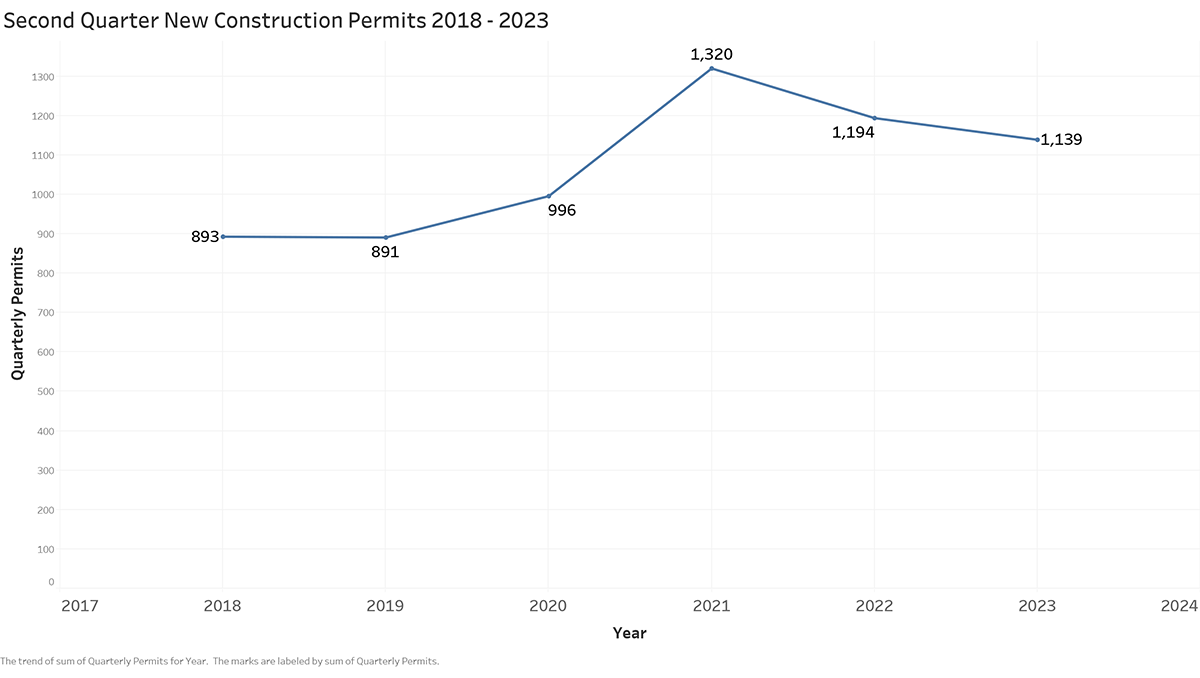

The second graph is Second Quarter building permits for townhomes and single-family from 2018–2023. On average over that period, there are 1,072 permits for the Second Quarter. 2023 is overperforming with 1,139 permits. This supports the thesis of a “scattered” scatter plot—one that doesn’t necessarily show a trend in any certain direction.

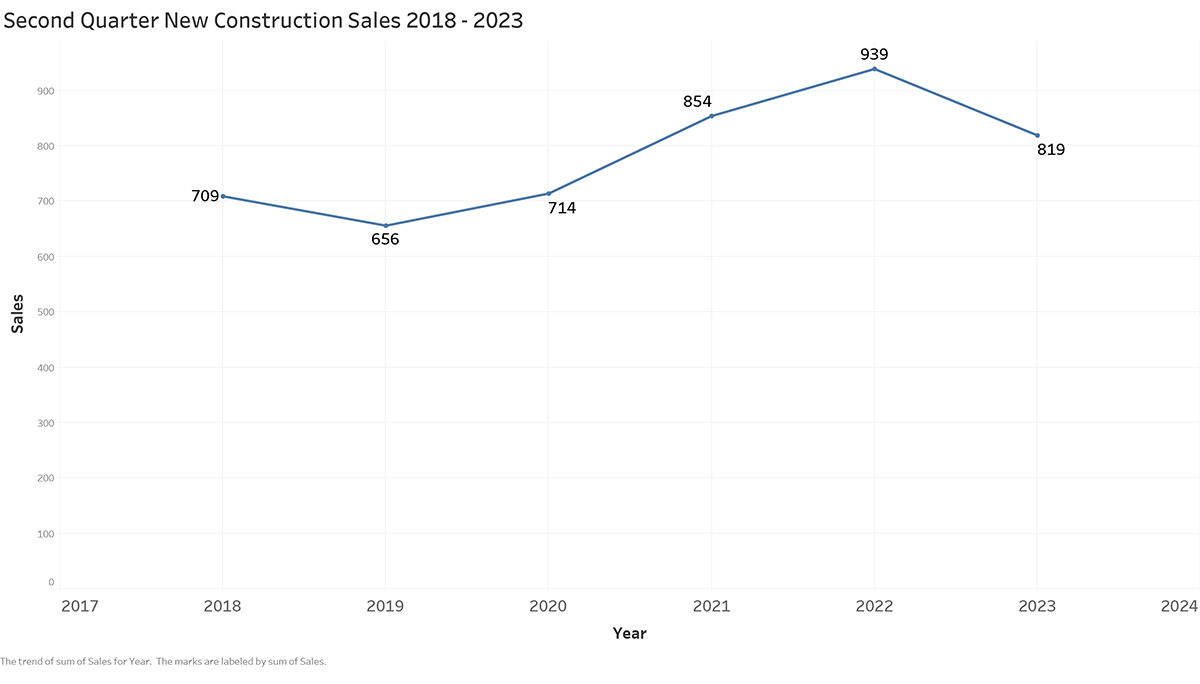

The final graph is Second Quarter new construction sales from 2018–2023. On average, there are 782 new construction sales for the Second Quarter. 2023 is overperforming with 819 new construction sales.

As one can see, the Des Moines metro new construction and development market is bullish in some indicators and bearish in others. There is one thing for certain, and it is that market indicators are all over the place. It’s like taking an Ironman discipline with a RAGBRAI mindset and trying to make predictions with both inputs. You simply can’t.

Uncertainty! One does not know what is going to happen next. It’s the most exciting part of life, however, it is also the scariest.

Nathan Drew, Broker/Owner of Drew Realty, a lot and development ground brokerage, has been in the business of lot and land acquisition and disposition since 2008. He keeps an ongoing inventory of all vacant lots and land throughout the Des Moines Metropolitan Area, and puts together a quarterly email blast with an interpretation of the metro’s lot market. Email Nathan to join his email blast list at Nathan@DrewRealtyUSA.com and follow him on Twitter @DrewRealtyUSA, on Facebook @DrewRealty, and on Instagram DrewRealty.